London, the dynamic and culturally rich capital of the United Kingdom, is always a hub of activity, offering a plethora of events and festivities throughout the year and this weekend is no exception. From enthralling theatre performances to lively celebrations and vintage treasures, there is something for everyone this weekend. We’ve rounded up our favourites below.

-

Anthropology at Hampstead Theatre

Date: 7th Sept to 14th Oct

Location: Hampstead Theatre

Website: Hampstead Theatre – Anthropology

This compelling play, set to run from 7th Sept to 14th Oct, offers a thought-provoking exploration of human connections and the complexities of relationships.

“Anthropology” delves into the intricacies of modern life and personal dynamics, weaving a narrative that will keep you engaged from start to finish. With a talented cast and a riveting storyline, it promises an evening of both entertainment and introspection. The Hampstead Theatre has a reputation for delivering high-quality performances, making it a must-visit for theatre lovers and anyone looking for a night of profound storytelling.

-

Oktoberfest at Between the Bridges

Date: September 22nd to 30th September

Location: Between the Bridges, Queen’s Walk, Southbank

Website: Between the Bridges – Oktoberfest

If you’re ready to immerse yourself in the lively spirit of Bavaria right in the heart of London, Oktoberfest at Between the Bridges is the place to be. Running from 22nd September to 30th September, this event promises a memorable experience filled with traditional German beer, mouthwatering food, and an authentic Bavarian atmosphere.

Oktoberfest is renowned for its vibrant celebrations, and Between the Bridges doesn’t disappoint. Live music and entertainment add to the festivities, creating an ambiance that’s both energetic and jovial. Whether you’re a dedicated beer enthusiast or simply seeking a fun time with friends and family, Oktoberfest is an event not to be missed.

-

Meet Me in Marylebone Village

Date: Saturday 30th September, 12pm – 6pm

Location: Marylebone Village

Website: Marylebone Village – Meet Me

In Marylebone Village

Be part of a bustling day filled with shopping and dining delights! Marylebone Village is hosting a Shopping and Dining Day dedicated to Marylebone Lane. It will be a day of engaging workshops, exclusive promotions, tempting offers, delightful alfresco drinking and dining experiences, specially crafted menus, captivating pop-up stalls, entertaining demonstrations, and so much more from a diverse array of retailers and restaurants. It’s a day you won’t want to miss! “Meet Me in Marylebone Village” offers a wonderful opportunity to discover the hidden gems of this picturesque part of London.

-

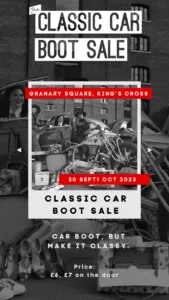

Classic Car Boot Sale

Date: 30th September and 1st October

Location: Granary Square,

Website: Classic Car Boot Sale

For vintage enthusiasts and automotive aficionados, the Classic Car Boot Sale is an absolute treasure trove of nostalgia and collectibles. Taking place on 30th September and 1st October in Granary Square, King’s Cross, this event promises a delightful journey through the past.

You’ll discover a wide array of classic cars, vintage fashion, and unique collectibles. Whether you’re on the hunt for a rare find or simply want to soak in the atmosphere, this event is a vintage lover’s dream come true. Explore rows of classic vehicles, each with its own unique story, and peruse stalls offering everything from retro clothing to antique furniture.